Bridging The Affordability Gap

The affordability gap is getting wider.

The UK housing affordability crisis has become one of the most pressing socio-economic challenges of recent decades. The scale of the problem is underscored by three key indicators: the steady rise in average house prices, the house price-to-earnings ratio, and mortgage payments for first-time buyers as a percentage of take-home pay.

Recent data from the Nationwide reveals the dramatic rise in average UK house prices over the past decade. Since 2014, average prices have surged from around £190,000 to over £270,000 by late 2024, an increase of nearly 50% in just ten years. Several factors have contributed to this relentless upward trajectory. Record-low interest rates throughout much of the 2010s made borrowing more affordable, fuelling demand and allowing buyers to stretch their budgets. Additionally, the COVID-19 pandemic briefly accelerated house price growth, driven by government incentives such as stamp duty holidays and a surge in demand for larger homes as remote working became widespread.

However, even as interest rates have risen sharply in recent years to combat inflation, average house prices have remained high, underscoring a fundamental imbalance between supply and demand.

House prices have outstripped average earnings providing further evidence of the affordability challenge. This ratio, which compares house prices to average earnings, has shown a stark and sustained increase since the mid-1990s. While the long-term average ratio sits at around 4.5, recent years have seen it remain well above 6, reflecting the extent to which house prices have outpaced wage growth.

The decoupling of house prices from earnings has made it increasingly difficult for prospective buyers to save for deposits or secure mortgages large enough to purchase homes.

A key driver of this trend has been the chronic undersupply of housing, particularly in high-demand areas such as London and the South East. Coupled with rising demand from buy-to-let investors and, in some regions, second home owners and even foreign buyers, this has created a market where prices have risen far faster than incomes for decades.

First time buyers (FTBs) are most significantly affected and many are now faced with increasingly unaffordable mortgage payments.

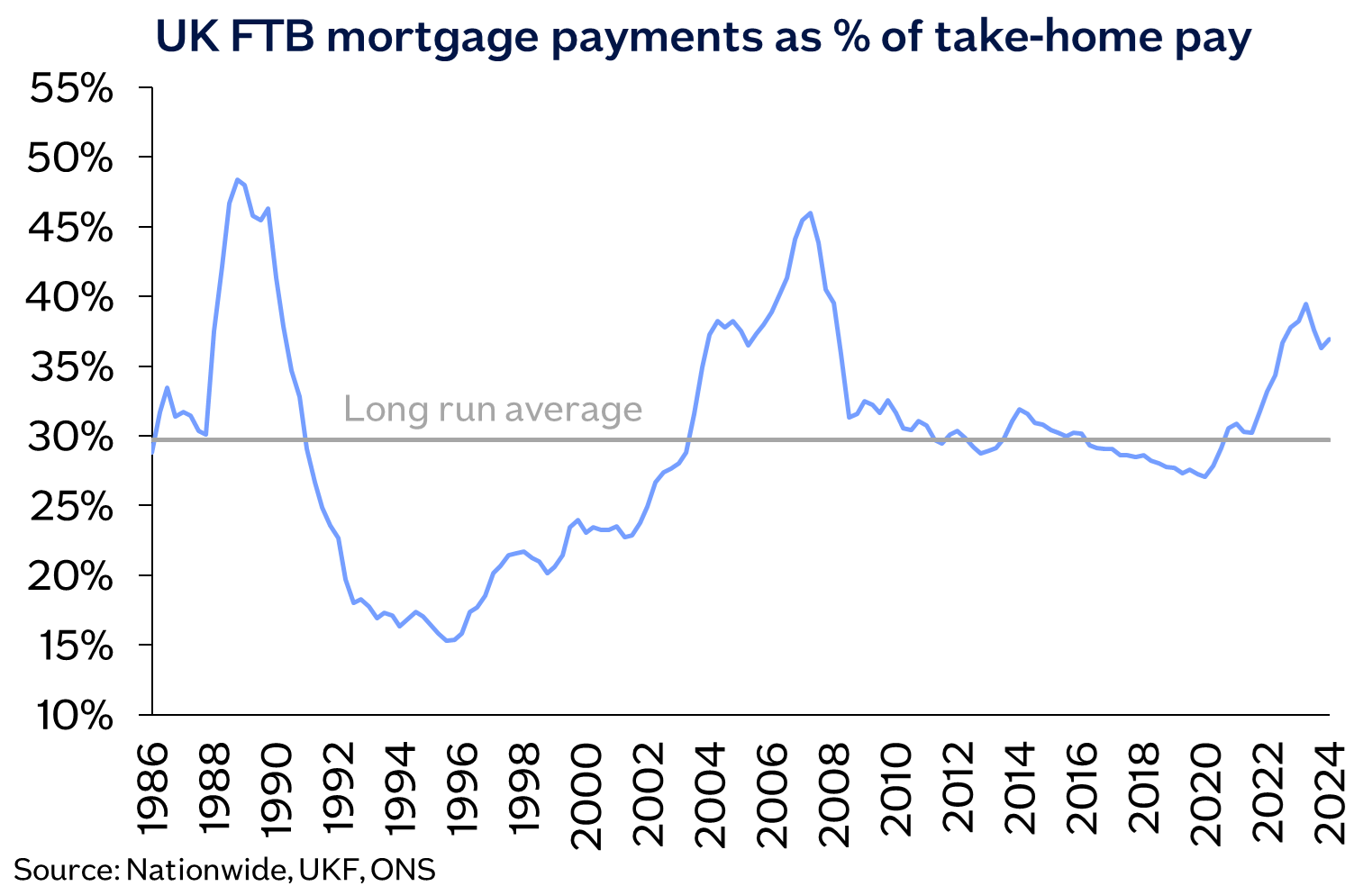

Historically, first-time buyer mortgage payments as a share of take-home pay fluctuated around a long-term average of around 30%. However, this figure has climbed dramatically in recent years, approaching levels last seen during the housing market peaks of the late 1980s and mid-2000s.

Rising house prices and the recent surge in interest rates have significantly increased the cost of monthly repayments, leaving many new buyers financially stretched. In London and parts of the South East, FTBs are paying over 50% of their take home pay on a mortgage.

For younger generations, who also face challenges such as student debt and stagnant wage growth, this affordability crisis has pushed home ownership further out of reach.

Addressing this housing crisis requires a coordinated and sustained response. Increasing the supply of homes is the most critical step. Successive governments have consistently failed to meet housing targets, particularly for affordable and social housing. Reforming planning regulations, incentivising faster construction and empowering local councils to build more social housing could help alleviate the acute supply shortage. Rising land costs and restrictive planning rules in high-demand areas must also be tackled to enable the construction of more homes where they are most needed.

Labour has pledged that 1.5m new homes will be built over the next five years to tackle the affordability crisis. For context, 997,000 were built in the last 5 years.

Bridging the affordability gap is going to take a monumental effort.